From cloud computing to climate change, thematic ETFs have been among the big winners of the pandemic, with money pouring into the sector and a raft of new funds being launched. But how should investors choose from the growing array of options of offer?

Thematic exchange traded funds (ETFs) have exploded in popularity during the pandemic as investors have jumped at the chance to participate in the opportunities afforded by tectonic shifts happening in the world, whether it be the transition to a carbon neutral economy or advancements in gene technology.

Funds under management (FUM) in thematic ETFs on the ASX grew by more than 70% to $4.3 billion over the six months through to April 2021, according to VanEck, which forecasts the acceleration of flows will push thematic FUM to $10 billion by the year’s end.

Thematic ETFs aim to track enduring investment trends, or “megatrends”, which often relate to macroeconomic or structural shifts in the economy that transcend the traditional business cycle. These trends include technological advances such as cloud computing, or AI and robots; and ESG-themes like climate change and clean energy.

Mat Tilley, Head of Market & Client Solutions at AUSIEX, said thematic ETFs appeal to investors eager to gain exposure to global investment themes and sectors that aren’t readily accessible in Australia: “The fundamental reasons for this thematic type investing is to supplement an already diversified portfolio that is predominantly Australian based.”

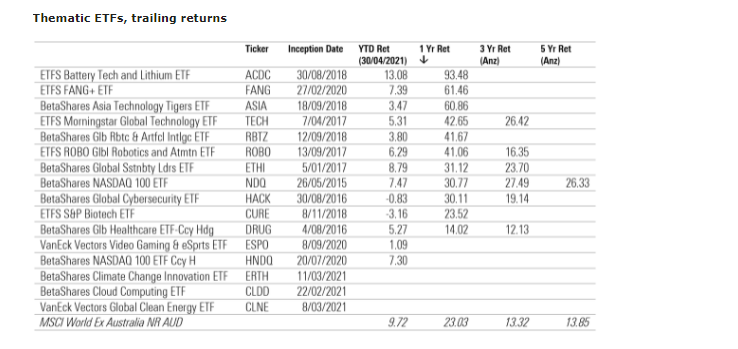

The best performing thematic ETF in Australia in the 2021 financial year was ETFS Battery Tech & Lithium ETF (ACDC), which rose about 69% amid surging demand for energy storage as corporations and governments reduce emissions and shift to renewable energy.

Source: Morningstar

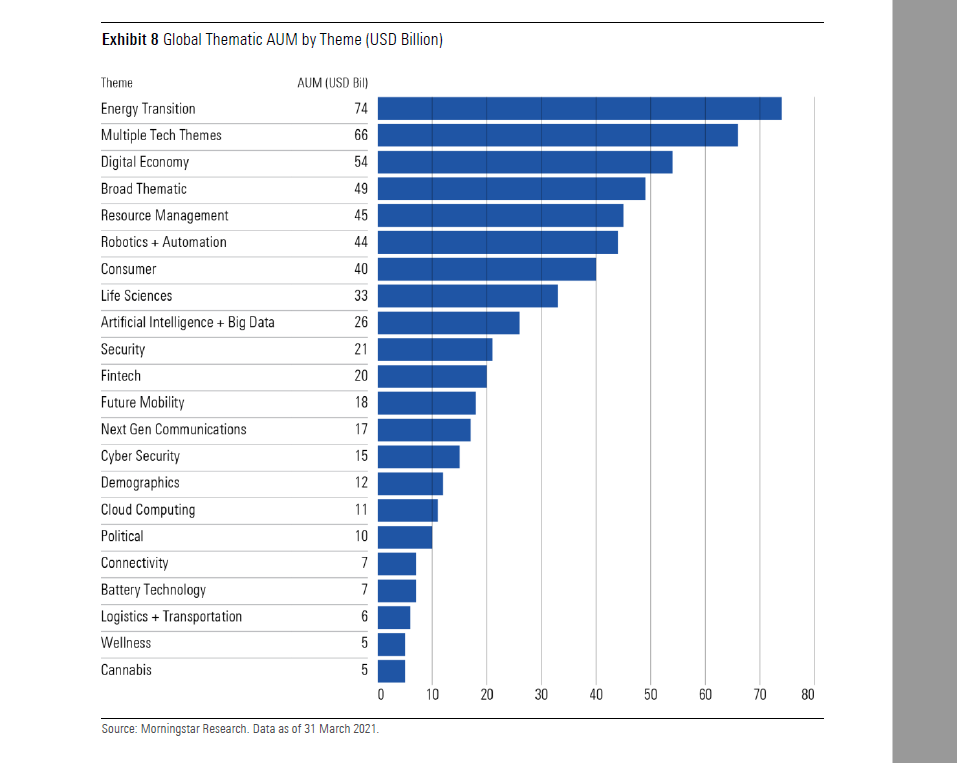

Source: Morningstar

Eye-catching returns

Strong interest in thematic ETFs is a global trend, with investor activity increasing dramatically in recent years. According to research by Morningstar, over the three years through to March 2021, assets under management in these funds more than tripled to US$595 billion from US$174 billion worldwide. The menu of thematic funds has also grown. A record 237 new thematic funds debuted globally in 2020, up from 167 in 2019. As of the end of March 2021, there were 1,276 thematic funds in Morningstar’s global database.

Morningstar’s 2021 Global Thematic Funds Landscape report found that many thematic funds have posted eye-catching returns during the global pandemic. More than two-thirds of thematic funds globally outperformed global equity markets in the year ended March 2021. However, this success rate drops to 43% when looking at the trailing five-year period, partly explained by the fact that thematic funds’ fees tend to be higher than those levied by their nonthematic counterparts.

There are several factors to consider when choosing a thematic ETF. Here we look at three key factors: picking a winning theme; matching the timeframe of the theme with your investing horizon; and ensuring you choose a fund that can harness your chosen theme.

Picking a winning theme

Morningstar says a robust theme should be logical, with a convincing narrative, a coherent and compelling growth story behind the strategy, and data to back it up. The strategy should also be loose enough to adapt as the specifics of the chosen theme inevitably evolve through time. As timely as they may seem now, some themes will age poorly, Morningstar says: “Investors must ask themselves: Will that work-from-home ETF still be relevant in three years’ time? On the other hand, it shouldn’t be so loose that it dilutes any potential gains or becomes too similar to often-cheaper, more vanilla existing sector or broad equity strategies.“

Match the theme with your investment horizon

Investors also need to consider the timeframe the theme is expected to play out in. “How will you know when to exit? Having preset exit criteria based on robust metrics such as valuation ratios will help protect against poor investment decisions. These should be monitored regularly,” Morningstar says.

AUSIEX’s Tilley stressed the importance of matching the expected timeframe of the theme with the investor’s own investing horizon, or in other words, how long they are happy to have their money tied up in the fund. “If investors want to invest and support the race to carbon neutral, that doesn’t happen tomorrow and they can look for solar energy and agricultural investments to play out over a five-to-ten-year period, whereas something like cyber security or electric car/battery technology have been developing more quickly.”

Source: Morningstar

Selecting a fund that can harness the theme

Aside from the narrative, implementation is key. Investors should look closely at how well a fund tracks its theme, Morningstar says: “While at face value the theme may be intuitive and appear to have durable investment merit, it might not be possible to capitalise on it via publicly traded stocks. This is because there are often few firms that represent pure plays on any given theme. Even when there are pure-play companies, there is no guarantee that they stand positioned to profit directly from a given theme. And even if they are, their growth might already be priced into their shares.”

Also, there tend to be several different approaches to harnessing any given theme: “Funds tracking a similar theme can end up being very different from one another. This creates an additional due diligence and ongoing monitoring burden for investors.”

The rise of thematic ETFs is part of a broader trend of growing use of exchange traded products among retail investors and advisers. They allow investors to gain exposure to big themes without picking individual stocks, and to expand the reach of their portfolio beyond their home market. Buying an ETF can also make it convenient to invest in a specific trend or sector in which an investor is interested. However, it’s important to take the time to choose a theme that matches your investment horizon and isn’t already priced into the market – and then to select a fund that can deliver on tracking that theme – in order to make the most of these innovative products and gain the most benefit for your portfolio.