Did you know there are seasonal patterns in the stock market?

February has historically been a flat to slightly positive month for major stock indices. The indices rise in February only abut 50% of the time, for a marginally positive average gain.

January just finished with the S&P 500 up just over 2% and the Nasdaq 100 up just over 1.5% for the month. There is something called the January Barometer which says how January goes, so goes the rest of the year for stocks. Since 1950, when January is an up month, the average return for the year (S&P 500) is right around 17%. When January is a down month, the average yearly return is -1.7%. Take from it what you will.

See full stats for each of the major indices below.

Stock market seasonal patterns are the directional tendencies of stock indices based on the time of the year. Certain times of the year tend to be more bullish (go up) for stocks, while other times during the year are more bearish (go down).

Seasonality is essentially an average, based on history, of how the stock market tends to perform throughout the year. Averages are a guide, a tool, but don’t forecast with accuracy what will happen this year. That said, some investors and traders may use seasonal tendencies to build strategies or enhance existing ones.

For example, if we know September tends to be a poor month for stocks, a trader who primarily takes long positions may opt to take this month off, or exit their positions quicker than usual if they start to decline during September. A trader could buy stock index ETFs (such as SPY or IVV) during seasonally strong months if the ETFs start rising. An investor may buy in and then sell out at certain times of the year (if feasible to do so with commissions). Buy and hold investors may wish to invest during seasonally weak months to take advantage of lower prices.

Seasonality can be used in many ways. Individual stocks, commodities, and currencies also tend to have seasonal tendencies.

So let’s jump into the seasonal patterns of the stock market.

Seasonal Patterns – Best and Worst Months for the Stock Market, Summary Table (20-year averages)

| Up Months | Weak Months | Best 3 Months | Worst Months | |

| NYSE Composite | March, April, July, October, November, December | January, February, May, June, August, September | April, July, November | June, August, September |

| S&P 500 | February March, April, May, July, August, October, November, December | January, June, September | April, July, November | June, September |

| Nasdaq 100 | January, March, April, May, July, August, October, November, December | February, June, September | March, July, November | February, June, September |

A full breakdown with monthly average gains and the percentage of time the month has moved higher is provided below.

Stock Market Seasonal Patterns

This is how the stock market has performed in each of the months over the last 10 and 20 years.

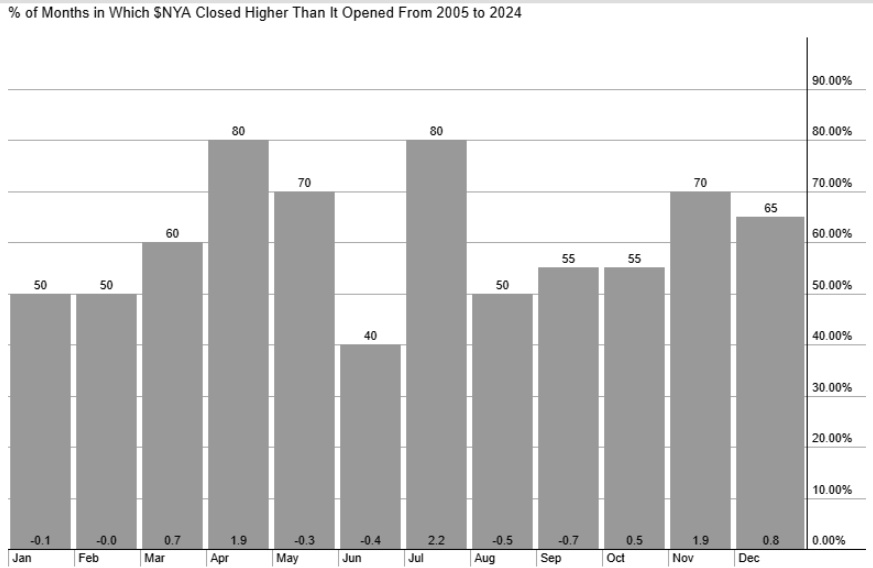

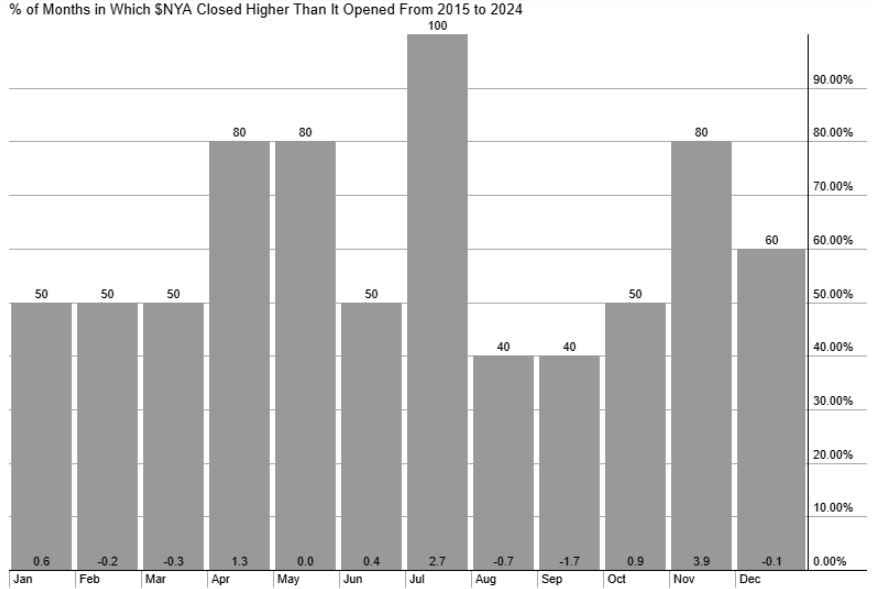

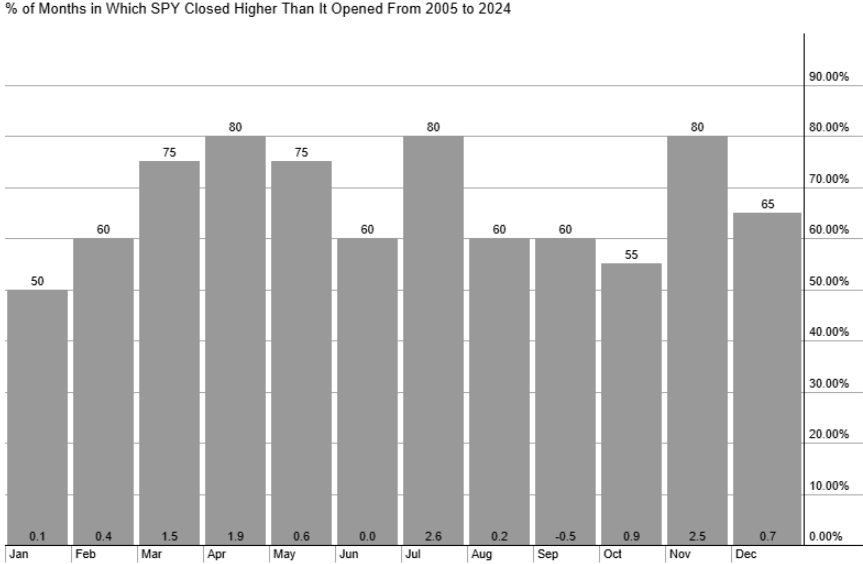

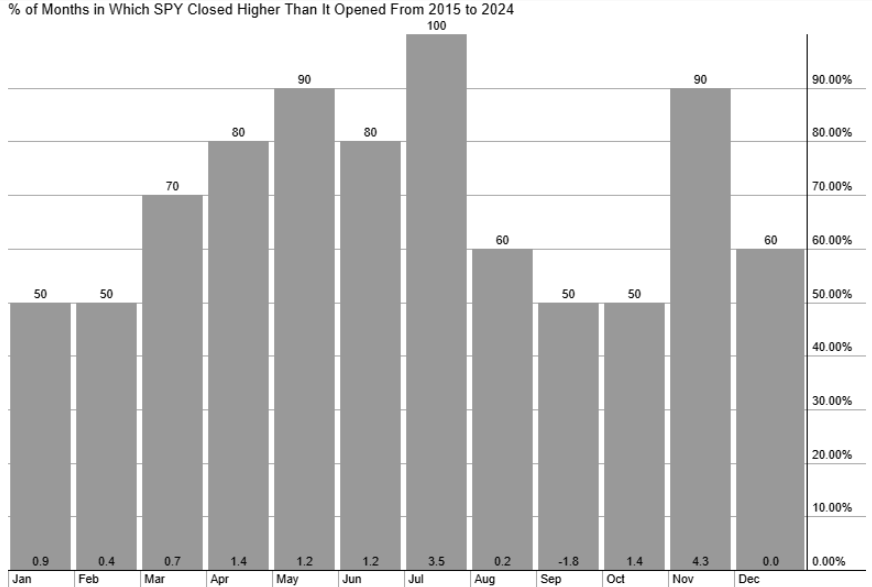

The number at the top of the column is the percentage of time the stock index has risen. If it says 70, that means the stock index went up in that month 14 years out of 20 (70%).

The number at the bottom of the column is the average percentage gain or loss in that month over the 10 or 20 years.

To give you a better idea of the best and worst months of the year, we will look at three major stock indices, the NYSE Composite, the S&P 500, and Nasdaq 100.

The NYSE Composite is all the stocks listed on the New York Stock Exchange so it’s a very diverse stock index. The S&P 500 includes only the largest companies in the US. The Nasdaq 100 includes large companies of which about 65% are in the technology or telecommunications sectors.

NYSE Composite Seasonal Patterns

Here is a summary of the NYSE Composite’s best and worst months over the last 20 years (2005 to end of 2024)

- Best Months: April, July, October, November, and December

- Worst Months: January, February, June, August, and September

Seasonal charts courtesy of StockCharts.com.

The above chart looks at 20 years of data. If we only look at the last 10 years (below), things change a little bit.

NYSE Composite best and worst months over the last 10 years (2015 to end of 2024)

- Best Months: April, July, October, and November

- Worst Months: February, March, August, and September

S&P 500 Seasonal Patterns

Here is how the S&P500 index has done each month. The SPDR S&P 500 ETF (SPY) was used to generate the seasonality figures. Over the last 100 years, the annualised return of the S&P500 is 10.6% per year.

S&P 500 best and worst months over the last 20 years (2005 to end of 2024)

- Best Months: March, April, May, July, October, November, and December

- Worst Months: January, June, August, and September

Over the 10 years, March through July, and also November, are even stronger. January has been a bit better, December is worse.

S&P 500 best and worst months over the last 10 years (2015 to end of 2024)

- Best Months: March, April, May, June, July, October, November

- Worst Months: September and December

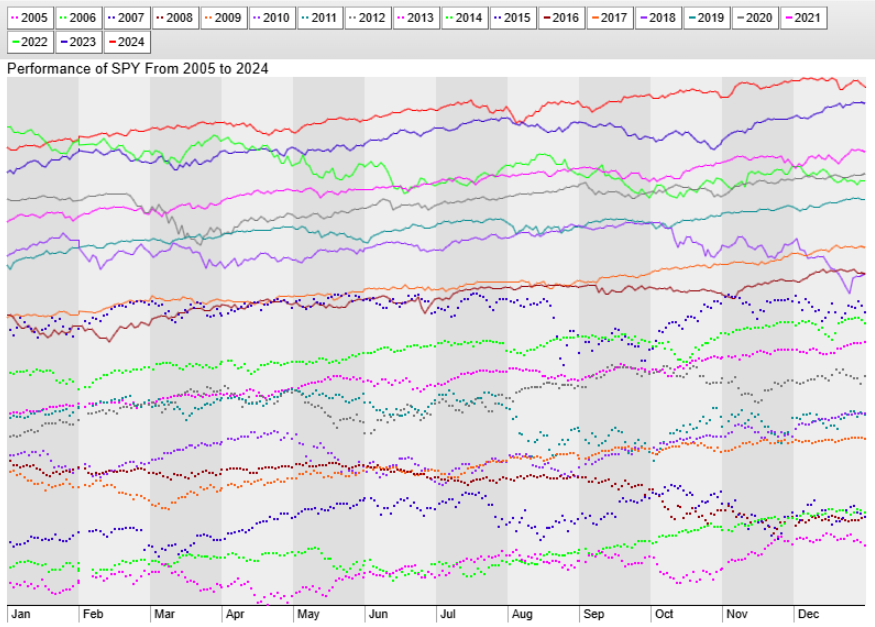

For a different look, and to see how some actual years have played out, here are the yearly charts of the S&P 500 (SPY) from 2005 to the end of 2024.

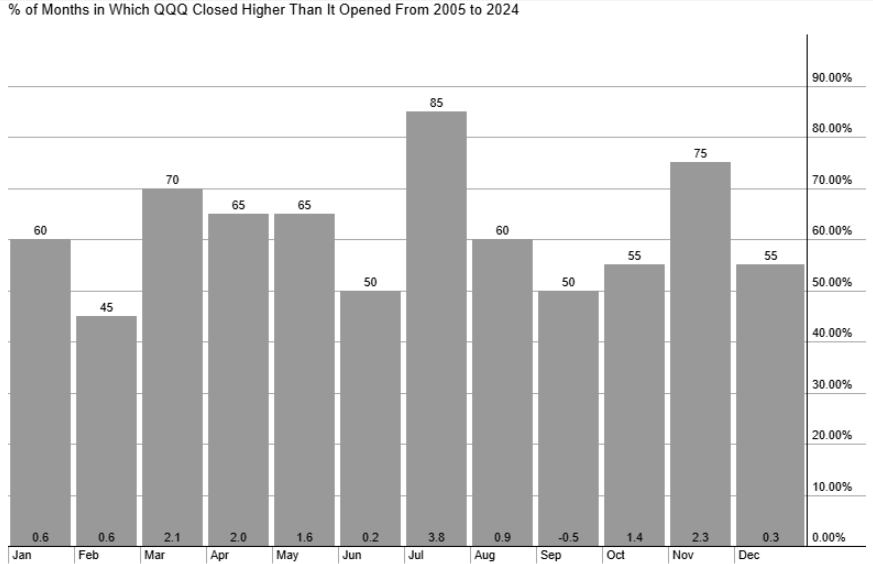

Nasdaq 100 Seasonal Patterns

Here is how the Nasdaq 100 index has done. The Invesco QQQ Trust (QQQ) was used to generate the seasonality figures. Over the last 20 years, the annualised return of the QQQ is 14.7% per year.

Nasdaq 100 best and worst months over the last 20 years (2005 to end of 2024)

- Best Months: January, March, April, May, July, August, October, and November.

- Worst Months: February, June, and September

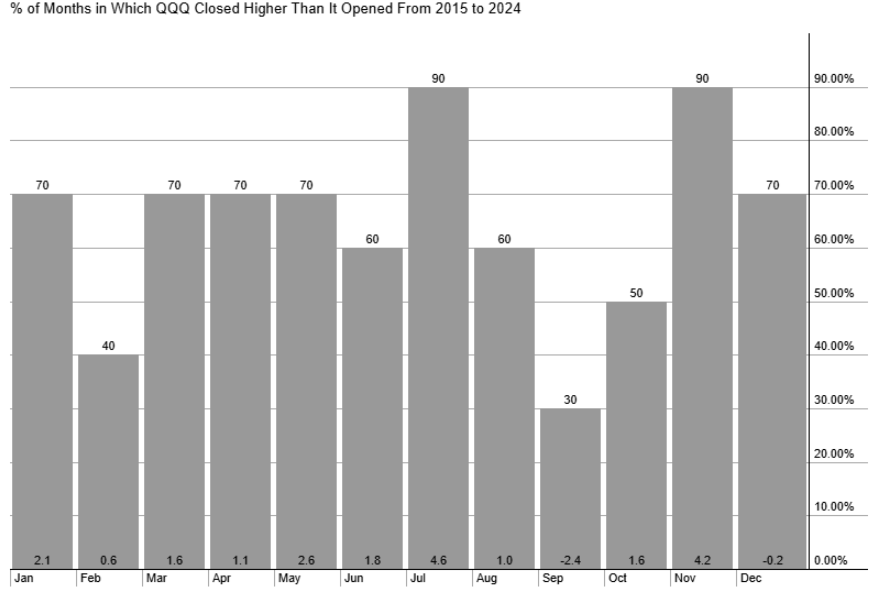

Below is what it looks like over the last 10 years. Not much has changed except September has been weaker and November stronger.

Nasdaq 100 best and worst months over the last 10 years (2015 to end of 2024)

- Best Months: January, March, April, May, June, July, August, October, November

- Worst Months: February, September, December

For a complete swing trading method, including scanning, stock selection, placing trades, and taking profitable exits, see the Complete Method Stock Swing Trading Course.

Stock Market Seasonality Considerations

Think of seasonality as a tool, not a crystal ball. It shows historical tendencies, not what will happen this year.

If the market tends to rise 80% of the time in April, that means it went up in April 16 years of out the last 20, but it may not go up this year.

The average monthly return numbers can also be skewed by an extremely large fall or rise in a particular year. So a 1% average return could be the result of a couple big drops of 10% in certain years and big rallies of 10% in others. The average is near zero, but investors should be aware that the average doesn’t tell the whole story.

Even during months that have a high probability of rising, stop losses and risk control should be used, because if the price drops, we don’t know how far it will drop.

The US stock market has an overall upward bias over the long term.

The S&P 500 has produced 10.6% yearly returns over the last 100 years.

The Nasdaq 100 has produced returns of 14.7% per year over the last 20 years.

The Russell 2000 has produced an average yearly return of 8.4%

Therefore, investors may consider using the weak months as entry points if looking to take long-term positions.

Additional Stock Market Seasonal Patterns

There are a number of specific seasonal patterns in stocks that people have noticed and tested. These tend to be shorter-term patterns.

Pre-Holiday Rally Pattern

It’s been noted that there’s a positive expectancy for buying stocks one to two days before a long weekend/holiday and then selling one to two days after. Trading volume tends to be lower heading into long weekends which may help explain prices drifting up (there’s a long-term upward bias to the stock market). Or possibly people are feeling good about a long weekend and buy some stock.

Short-term traders would buy one or two days prior to the holiday, and then sell one to two days after the holiday. Longer-term traders can also take advantage and use the one or two days prior to a holiday to pick up some stocks they were eyeing.

Actual testing reveals that most holidays don’t produce a big pop in stocks, but a few are more reliable and tend to produce positive returns over time:

- July 4th

- Thanksgiving

- Christmas (discussed more below)

At least according to history, these are better holidays than others for deploying the pre-holiday rally strategy.

Post-Holiday Rally Pattern

Buying on the close the day after the holiday and then selling on the next close has also shown a steadily rising equity curve

Santa Claus Rally Pattern

This one is highly documented and generally quite profitable, yielding an average of about 1.1% per trade in an index like the S&P 500. The strategy requires holding for the last 4 to 5 days of the year and then selling two to three days into the new year. The exact number of days can vary based on weekends and market closures. So utilize the closest number of days you can.

Intraday Patterns

There are also intraday repeating patterns that play out, which are useful for short-term traders and day traders.

Stock Market Seasonal Patterns Conclusion

Seasonal patterns can be useful, but they can also be traps if we blindly follow them. Risk management must always be used to control losses, yet that may also mean getting out of some trades that would have otherwise been profitable if the favorable seasonal statistics played out.

Most season patterns are not statistically significant, meaning they are not based on enough data or haven’t accounted for other factors. They are essentially ideas with some evidence.

Before putting your capital to work based on seasonal patterns you may wish to do more thorough research.

Article reproduced courtest of Tradethatswing.com